can you overdraft your bank account with cash app

APP Card Walmart Can I overdraft my cash APP card-----Our mission is informing people correctly. The Cash Card isnt connected to your bank just the app.

How To Link Your Lili Account To Cash App

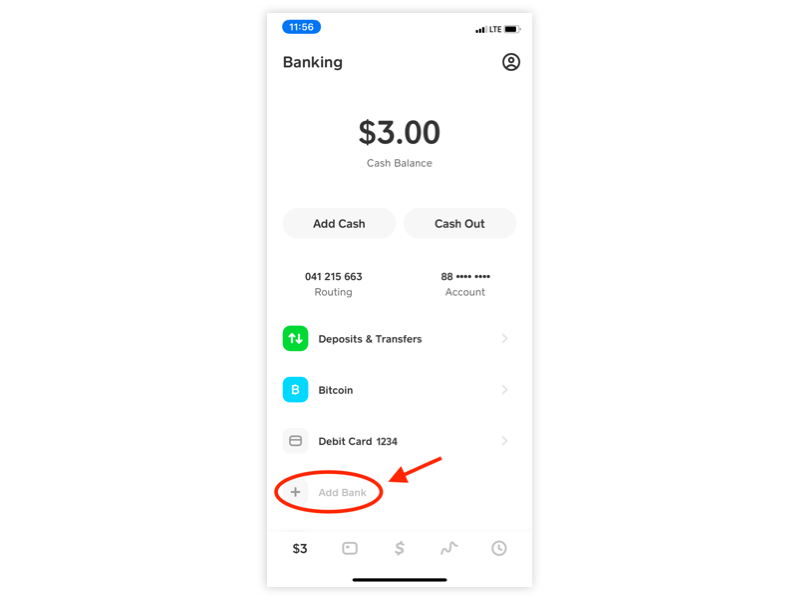

Select Linked BanksAccounts or Add Bank.

. Declined transactions are typically not subject to overdraft fees. As we stated earlier Square Cash publishes no hard limits on spending using your Square Cash debit card unlike the 2500 limit imposed on Square Cash P2P. Once youve received an offer from us simply log into your Online banking account or the Cashplus Bank app navigate to the overdraft screen within Add-ons or from the tile on your Account Overview and.

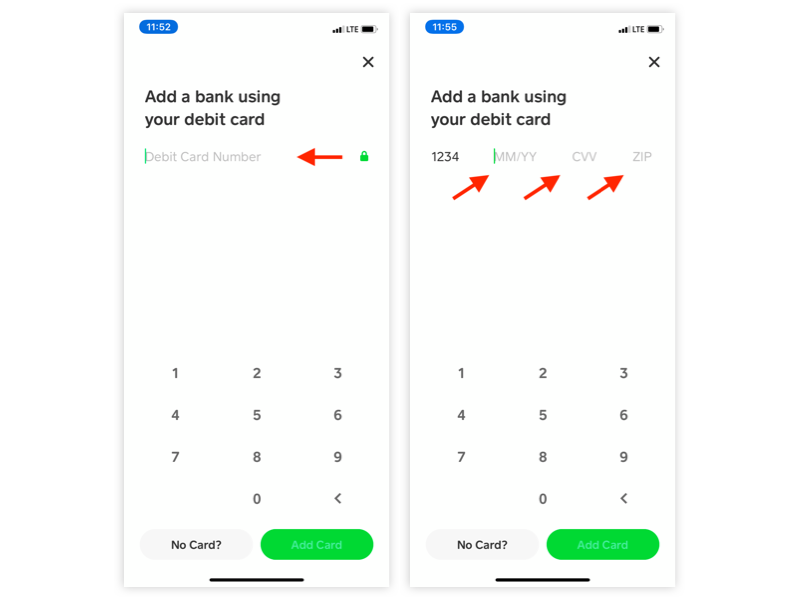

Enter your ZIP number. Add the CVV number. Launch the Cash App by touching the home screen.

WRIC Money transfer apps like Venmo Zell and Cash App have been growing in popularity during the pandemic but 8News has. To be eligible for SpotMe you must be a US. Use apps like Dave or apps like Earnin for a cash boost.

How To Use Cash App Borrow. Cash app can not overdraft if the expense is greater than your balance it declines. You can also link your checking account to your savings account.

In this article we list eight banks that let you overdraft immediately. Add the expiration date. Fee for expedited transfer from your Cash App account to a linked account.

Take advantage of no-fee alternatives like PockBox Current Go2Bank and SpotMe. To modify a linked bank account. Earnin withdraws the cash you borrowed from your bank account on your next payday.

Press the Add Cash button. Its therefore useful to know which online banks allow overdrafts instantly so you can get cash right away. Unlike traditional overdraft protection qualifying.

Tap the Profile Icon on your Cash App home screen. Enter the card number. The weekly withdrawal limit is 1000 per week and you cant withdraw.

You can also link it to your credit card but remember that cash advances on your credit card have EXTREMELY. The Cash app has two types of transfer limit. Tap the Banking tab in your Cash App.

750the fee for withdrawing 500 from cash app. Tap the Add button. Check for the word Borrow.

Automatically if you go overdraft in your checking account your bank will automatically transfer money from savings to checking. Its common for a bank to charge. A Cash App con that could wipe out your bank account.

You can frequently monitor your bank account for bank balance and. Go to the Banking header. Having insufficient funds in your account to cover a transaction will usually trigger an overdraft fee.

Choose the amount of cash that you want to add. The transaction is returned unpaid and is commonly known as bouncing. Most app fees are under 10 while bank overdraft fees average 35.

The Cash Card isnt connected to your bank just the app. This video was also made on the basis of these guide. Sign up for overdraft coverage and continue to overdraw your debit card.

Tap the Profile Icon on your Cash App home screen. You may be able to link a savings account to your checking account so that the bank or credit union will take funds out of the savings account. In effect you can use Square Cash as your bank account if you wanted to as you can deposit your pay into Square Cash and use the Cash apps linked debit card to make everyday payments.

Hes definitely using that money for something shady. Select a deposit speed. Confirm with your PIN or Touch ID.

You also need to receive a single deposit of 200 or more in your Spending Account 34-days prior. 6 rows Depending on your personal circumstances we recommend the following apps that let you. Choose an amount and press Cash Out.

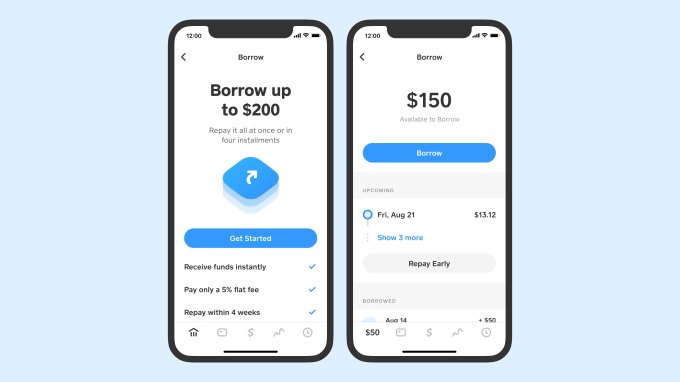

Your bank account can be linked to a Cash App account so that you can use it as a debit card. Cash App will tell you how much youll be able to borrow. The app also has a feature that notifies you when your bank account balance is low and a feature that will top it off for a fee.

Tap Link Debit Card. No fee to transfer money from your Cash App account to a linked account with the standard option. These widespread scams target random users to click on a link and enter their account details or tell them sensitive information over the phone.

If you need to draw more than you have in your account the bank will spot you up to 200 on your cash withdrawals and debit card purchases. Cash App Support Cash Out Instructions. Citizen above 18 years.

Tap the Confirm button. After you have entered all the details you will be presented with a checkmark if all went well. Whatever your choice just remember there are a number of resources that can put cash in your pocket.

In addition to the amount of the original transaction most banks and financial institutions charge fees each time you overdraft. Chime offers a program called SpotMe that offers a bank overdraft limit of up to 200 without overdraft fees. Once confirmed you can link your debit card and bank account to Cash App and continue providing personal information.

If you see Borrow you can take out a Cash App loan. 1000 per 7-day period. Select your banking account.

Cash app can not overdraft if the expense is greater than your balance it declines. Can you overdraft with cash App. Tap Remove Bank or Replace Bank.

Yes Cash App lets you borrow money. Select the bank account you want to replace or remove. When you dont have enough money in your account to cover withdrawals or transactions youll experience an overdraft.

Enter the PIN connected to your bank card. Chime 200 free overdraft. Check for the word Borrow If you see Borrow you can take out a Cash App loan.

Real landlords will show you the house in person and take a check or a bank transfer rather than Cash App payment or wire transfer. It will just fail. Automatically if you go overdraft in your checking account your bank will automatically transfer money from savings to checking.

Free atm withdrawals if you set up direct deposit. To cash out funds from your Cash App to your bank account. As you can see this can tap out your account pretty quickly.

Tap the Balance tab on your Cash App home screen. You can use the card to make ATM withdrawals up to a limit of 250 per transaction and per 24 hour period. Call email and text phishing.

Overdraft protection is a banking feature that prevents any transaction that would cause your account balance to fall below zero. Tap on your Cash App balance located at the lower left corner. The money is typically available in 1-3 business days.

Cash App Balance How To Check Cash Card Balance And Add Money Cash App

Square S Cash App Tests New Feature Allowing Users To Borrow Up To 200 Techcrunch

Can You Overdraft Cash App All You Need To Know

Learn About Cash App Overdraft Limit L Fix Cash App Negative Balance Cash App

Cash App Review Fees And Limits Explained Finder Com

How To Add Money To Cash App Card In Store Or Walmart

Don T Have Cash App Borrow How To Unlock Loan Now 2022

/images/2022/02/08/cash-app-and-venmo.jpg)

Cash App Vs Venmo 2022 How Do They Compare Financebuzz

Cash App Borrow Cash App S Newest Loan Feature Gobankingrates

Can You Overdraft Cash App Card How To Fix Overdraft Cash App Card

2022 Can I Overdraft My Cash App Card At Atm Gas Station Unitopten

Learn How To Activate Cash App Card In Simple Steps

4 Steps How To Lock Cash App Card Or Deactivate Unitopten

Does Chime Work With Cash App Complete 2022 Guide Atimeforcash Net

How To Link Your Lili Account To Cash App

Square S Cash App Tests New Feature Allowing Users To Borrow Up To 200 Techcrunch

Square S Cash App Vulnerable To Hackers Customers Claim They Re Completely Ghosting You